First setup

Migrate Your Existing Tax Setup

Before you can dive into international sales, you'll need to migrate your store's existing tax setup to our new system. Don't worry, it's a straightforward process guided by a simple step-by-step tool.

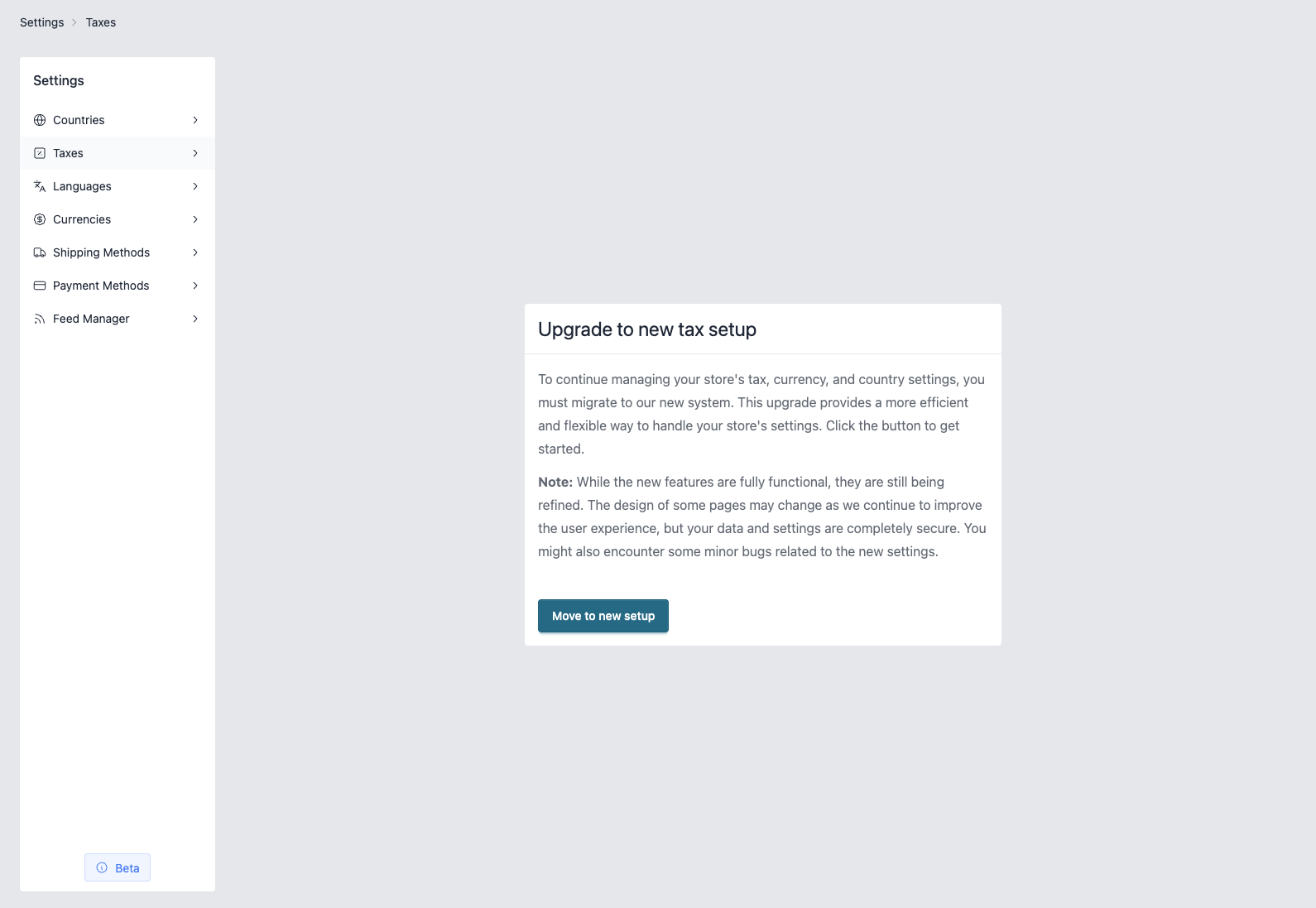

You can access the migration guide by simply opening one of the menu items for VAT or Country in your control panel.

Migration tool

The first time you open a menu point leading to countries, languages or tax, you'll see a clear message prompting you to migrate to the new tax setup

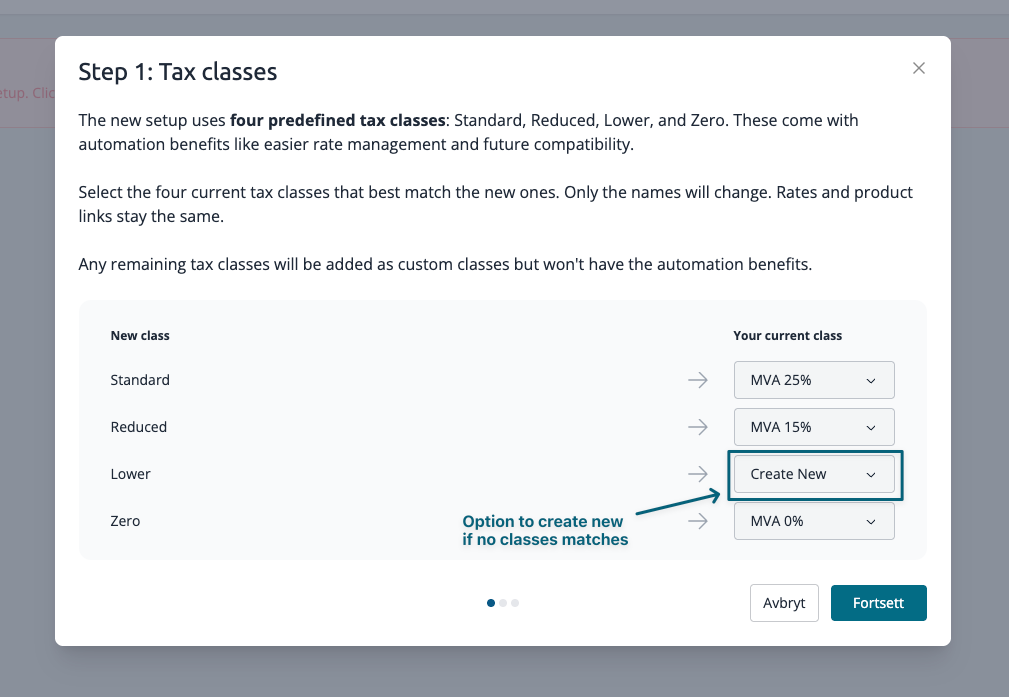

Connect tax classes

Next, you'll find a module that helps you connect your current tax classes to the new system's classes. These are pre-selected to match your existing setup, but it's crucial to double-check that everything is correct. The new setup is designed to align with how many accounting firms use tax classes, offering a more standardized approach. You also have the flexibility to create new tax classes if needed.

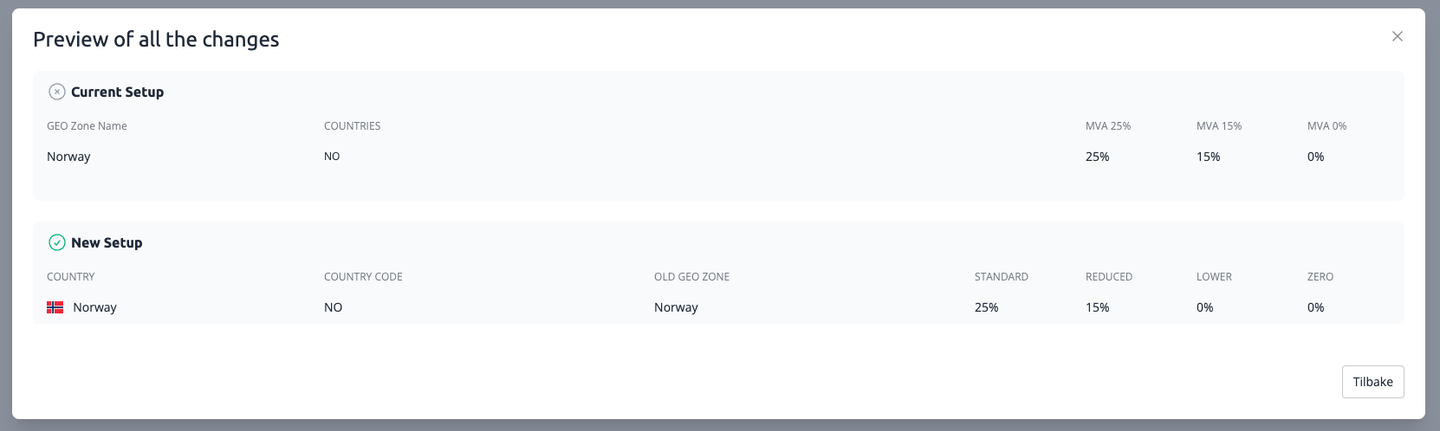

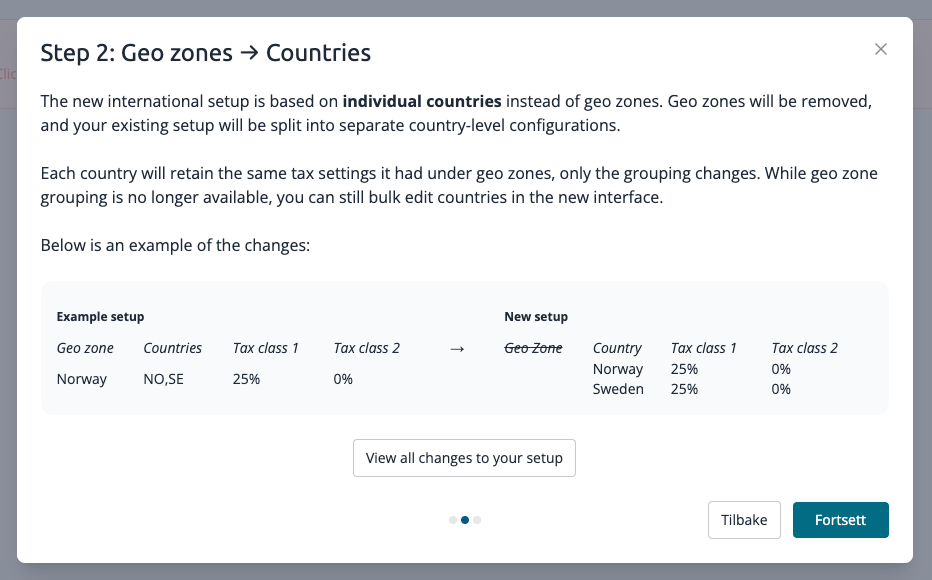

Geo zones vs. countries

Our new international setup is based on **individual countries** rather than geo zones. This means your existing geo zone configurations will be removed and automatically split into separate country-level configurations. Here's a preview of how this change will appear:

To see a detailed overview of all the upcoming changes to your setup, click "View all changes to your setup".

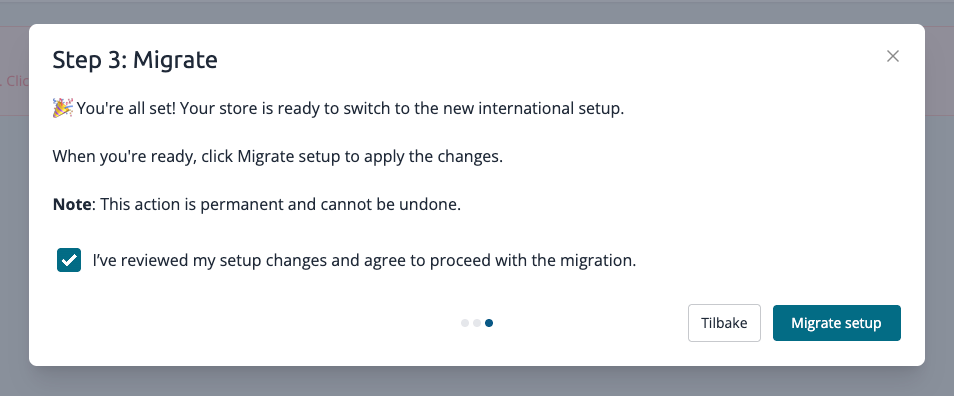

Confirm the new setup

The final step is simply to **confirm the migration** to the new tax setup. Once confirmed, your store will be ready with the updated international tax configurations!